Wholesale energy prices and Agile Octopus

At Octopus, we create smart energy tariffs like AgileOctopus with pricing that varies throughout the day based on the current wholesale market price of energy. But it’s much more than a cheap tariff: it’s an experiment, a key part of our mission to drive the transition to a 100% renewable energy system.

AgileOctopus prices are calculated automatically in the evening based on the next day’s wholesale price forecast (read our Agile pricing formula here). Tonnes of different factors from the weather, to politics, to huge global crises like COVID-19 and the war in Ukraine, can affect the wholesale price of energy.

Where most conventional energy tariffs are hedged months in advance so customers only feel the effects of really long-term wholesale changes, Agile’s dynamic pricing means short-term market changes can make a big difference.

In this blog, our energy procurement team will give the scoop on the market conditions that have led to particular changes in our Agile tariff’s rates.

Skip to up-to-date information about market conditions affecting Agile prices

Update January 2023: In the ongoing energy crisis, wholesale prices are around 4x normal levels and volatile. You can read more about what's going on here.

At present, Agile prices are at the 35p / kWh cap most of the time – roughly 1p / kWh more expensive that the current Energy Price Guarantee rates.

But first, a quick note on why we create products like AgileOctopus.

While it’s amazing to be able to pass cheap prices on to customers, that’s not why we’ve created our smart tariffs. Agile is an experiment designed to transform the way our society uses energy – and a key part of that involves price ‘peaks’ as well as plunges.

Our plan with a tariff like Agile is to make using energy cheaper when it’s greener, and more expensive when it’s dirty, in the hopes of helping people change their energy use accordingly – reducing the need for fossil fuels, and making the most of renewable energy at times when the wind is blowing and the sun is shining.

That means AgileOctopus has both super low (sometimes negative) price periods when energy is very green, AND on the flip side, also some pretty pricey peak periods (previously capped at 35p / kWh, but now 100p / kWh as of Oct 2022) when the system is under lots of pressure and so more carbon intensive.

When prices are higher, AgileOctopus isn’t broken - it's working exactly as it should. Much like when the train station gates shut during rush hour, Agile’s higher price periods signal to customers when they should avoid using power then as much as possible to save cash and carbon, and avoid straining the grid.

As a customer on this innovative tariff, you have to take the ‘highs’ with the ‘lows’. We saw incredible, sustained low prices throughout the UK lockdown, when super sunny and windy days combined with unprecedented low energy demand to lead to a ‘perfect storm’ for power prices. On several occasions, Agile customers were paid to use energy.

More recently, we’ve seen some higher priced days as wind generation has dropped, the price of gas has risen, and ‘heatwave’ temperatures have seen demand for energy – and therefore, wholesale energy prices – creeping up a bit around the world. The most important thing to remember is that the conditions driving higher prices are a part of the same wholesale dynamics that affect all energy costs – they just show up very directly in Agile. In the long run – all energy tariffs reflect energy cost increases otherwise companies would go bust.

Will I save money on AgileOctopus?

AgileOctopus has, to use Greg’s favourite expression, bonkers cheap energy. Even in recent months when the prices go ‘high’, the average daily price on agile octopus is usually significantly cheaper than a standard tariff.

In the long run, whether you save will largely depend a lot on how much you change your energy use.

If you use energy exactly as normal, you’ll likely end up paying around the same as a standard fixed tariffs, because the expensive prices during the daily evening peaks are balanced out by ~21 hours of cheaper ‘off-peak’ energy every day. If you shift your usage out of the peak times, you could stand to save money.

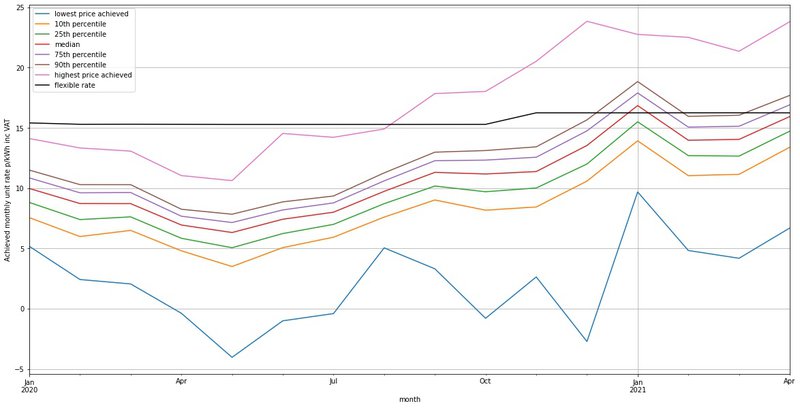

Across the last year (April 2020-2021), nearly all Agile customers still got cheaper energy than our average fixed price – even during the 'most expensive' periods of time:

Balanced out with the months of cheaper prices in lockdown one, generally customers are still saving lots across a whole year. This clearly shows that Agile is all about what you do with it. even if you don't shift much of your energy use at all, you'll likely still save a bit, or break even. Nut people can attain super-cheap prices by shifting their energy load as much as possible, using up more green electrons and using less power when there's loads of fossil fuels in the system.

So, what’s going on with wholesale prices?

27/09/21

As the weather gets colder, we're all starting to think more about our heating. It has been windier, but we'd expect that this time of year and there was a lull in the wind earlier in the week which caused a drop in expected wind generation. France also has some nuclear and hydro down at the moment - and as a result more power than expected is being exported to the continent.

Will Agile prices drop? We hope so. We are still in the midst of an energy crisis driven by Russian gas supply constraints and there isn’t a lot of firm capacity that we can turn on when the wind isn’t blowing that doesn’t rely on burning expensive fossil fuels, and carbon prices have been hitting new highs for the last 3 months. These things will change, but at the moment the price of energy is very expensive. We don’t set Agile prices, they reflect the day ahead wholesale price for power, so it is particularly sensitive to changes in the underlying price of power. At the moment that means that it has become expensive, but it’ll also come down quickly as soon as wholesale falls.

06/09/2021

Low gas supply, less wind, and high carbon credit prices push electricity prices to an all time high:

So what's going on? Well, continuing on from our last post, gas is still in short supply for many of the reasons we mentioned before. Given that burning gas still makes up a large portion of the UK's electricity, this has driven prices through the roof.

It's also not very windy! The UK is only generating around 450 MW of electricity from wind right now. That's about 1/10th of the average generation in the last five years. Luckily, this is a short term factor.

What's more, generators that emit carbon into the atmosphere are required to purchase carbon allowances to offset their emissions, but Since 1 February 2021 the price of the 'European carbon allowance benchmark' has increased by 69%, driving prices even higher.

EUROPE'S ENERY CRUNCH: UK day-ahead electricity prices have surged to an all-time high of £219 per MWh, that's ***more than quadruple*** the average 2010-2020 price. Multiple factors affecting, including sky-high gas and CO2 prices, low nuclear and super-low wind pic.twitter.com/kz2lBPlh0c

— Javier Blas (@JavierBlas) September 6, 2021

Wow! I'll definitely have my batteries exporting tonight then - thank you! :)

— Bernard McCarty 💙 (@BernardMcCarty) September 6, 2021

29/06/2021

Low gas reserves in Europe, low gas supply into Europe from Russia and high demand from China mean Agile prices are higher than they’d normally be at the moment:

For starters, gas storage across Europe is currently 33% below the 5 year average for this time of year? So why does this matter? Well, a fairly high portion of UK energy still comes from burning gas, especially during peak hours (4-7pm) when industry is still running, and people are coming home from work. (That’s why smart time-of-use-tariffs like Agile Octopus are so important - they reward customers for using energy during off-peak times, when it is cheaper and greener - reducing our dependence on burning gas!) All this means that wholesale prices are trending higher at the moment, which in turn effects Agile Octopus - you can view our Agile pricing calculation here.

What’s more, an unexpectedly cold winter and strong post-Covid industrial demand across China raise prices in Asia, so gas cargoes are currently favouring Asia over European gas hubs, raising prices here too. This is making the supply shortage in Europe worse too.

Russia's Gazprom also supplies gas to Europe through a number of pipelines. One of the major pipelines used to supply gas from Russia to Europe runs through Ukraine. This pipeline often becomes embroiled in the ongoing political tension between Ukraine and Russia and 2021 is no different. For this reason, the flow of gas from Russia into Europe has remained lower than expected despite European Gas prices hitting 13 year highs. A new pipeline that will bypass Ukraine and run under the Baltic sea (NordStream2) is due to come on supply in 2021 and consequently the market expects the price of energy to fall in 2022

Finally, we’ve recently heard that the Dungeness B nuclear power station will not be returning to service. It has been offline since 2018, but the expectation was that it would be returned to service by the end of 2021. The reduction to energy supply has had an impact on power contracts dated for the near future, however this has been partially offset by new interconnector capacity.

All this has conspired to raise Agile prices for the time being!

16 April 2021

Low wind, chilly temperatures and the ‘flexibility crunch’ are leading to some higher Agile prices at the moment

These are some of the key reasons for the higher ‘spot pricing’ seen in the past few days…

- It’s very cold, and there’s not been much wind – a killer combo that means low wind generation, and more people turning on the heating which increases demand and pushes prices up.

- A few different assets and generators have been offline, from EDF’s nuclear sites being offline to some key interconnectors (which transport power to us from Europe) being down.

- Gas imports from Norway have been particularly low recently, driving up gas prices which then has a knock-on effect to all wholesale pricing (this is expected to pick back up to normal by the end of April).

Some people have asked questions about prices going up longer-term – since October, wholesale has increased around 33%. I wanted to make a few points about that.

Firstly, anyone that's keen to compare Agile pricing this year to last year should note that last summer's prices were, to use everyone's favourite pandemic word – unprecedented. Last Summer’s complete halting of industry and business as we entered lockdown caused a situation rarely seen in the energy market – with record-low national energy demand, and a regular oversupply of green energy leading to sustained low prices.

Here you can see wholesale 'baseload' prices increasing steadily in the past year – the price to buy for October 2021 is currently 60% more expensive than the cheapest period in the past year (April 27th 2020)

Basically, if you want to compare this year’s Agile prices to a ‘typical’ period, last Summer isn’t it. Agile customers got access to a few months of bonkers cheap prices, and several periods of customers getting paid up to 10p/ kWh to use energy – unbeatable prices as reward for using up spare green power, which really did help enormously to balance the grid through a chaotic time. As life begins to head back to ‘normal’, energy prices are too.

A second reason prices are looking a little high recently is what we call the ‘flexibility crunch’. As we race to a 100% green energy system, coal, gas and nuclear generators are retiring, and more renewables are coming onto the system. However, increased grid ‘flexibility’ – large-scale battery storage, pumped storage, and other solutions – aren’t ramping up as fast as we need them to to keep the grid balanced.

Essentially, our system is becoming more reliant on when the wind blows and sun shines. When those things aren’t happening, we need to be able to call upon other generation to fill the gap. If there isn't as much of that "other" generation then the prices will be higher (usual ‘supply and demand’ drill).

We need to do more, faster, to make sure we’ve got enough green ways to get power when the wind isn’t blowing and the sun isn’t shining. Happily, Agile customers are the early adopters showing that consumers can be a huge part of the solution.

The final important factor to point out is carbon credit prices. At the moment a lot of the “other generation” that fills the gaps left by renewables comes from fossil fuel sources. These generators have to buy carbon credits when they generate power reasons. At the moment the prices of those credits is double that of what it was back in June and it looks like there are some big speculative investors who are entering the market.

Because of this the cost to generate from fossil sources is increasing and therefore, so do prices. Here's a more detailed explanation about what's going on with the price of carbon, and how it's impacting the power market.

The green line is the price of carbon, which has increased a huge amount in the last year, contributing to overall wholesale increases

Happily, Agile customers' incredible efforts to shift their usage out of the pricier time periods means some Agilers are still averaging cheaper than a standard tariff.

The average cost of our electricity over the last month on @octopus_energy Agile tariff was 12.92p. The last 4 of those 31days included our new ASHP consumption; those days averaged 15.12p (excluding PV self consumption). pic.twitter.com/APAIl5IJaC

— Dominic Zapaman (@Zapaman) April 14, 2021

Because so far the cost of Agile is much less than Standard for my use and about the same as Go according to @OctoComparison

— Andrew Bissell (@eLEJOG) April 14, 2021

But I learn much more (and deliver more system value) by aligning to Agile pic.twitter.com/RYor36adV7

And the higher wholesale prices at the moment are brilliant news for people who generate their own power and export it on Outgoing Octopus...

When the grid needs a little boost in the evening peak, I’m only too happy to help out with my stored ☀️ power -

— Jesse Bryce (@jesseb4me) April 13, 2021

Getting paid 37p/kWh for dumping 50% of my home 🔋 to the grid on @octopus_energy #agile tariff, as displayed so nicely by @myenergiuk!#renewable #energy pic.twitter.com/EGPtqT8atS

How to beat the high agile import prices ! Export and get paid 33p/kWh. The benefit of @octopus_energy agile outgoing over SEG #agile #myenergi #pvsolar #homestorage pic.twitter.com/nvpt5XuFE0

— Scott McMartin 🏴 (@scottmcmartin) April 13, 2021

6 January 2021

Chilly, still winter's days, plus some changes to some key power stations the UK relies on, have led to higher Agile prices.

What’s driving high market prices?

The weather

The UK’s current climate reflects a pretty tricky winter weather phenomenon. Areas of high pressure all over the UK have led to clear, cloudless skies, making things incredibly cold, and making the wind drop off considerably. These factors are a ‘perfect storm’ for high energy prices. Why?

- The unseasonal cold increases energy demand. It’s unusually cold right now. In London, for example, weather is forecast to drop below 0 – 3 degrees below the seasonal norm. When the weather’s colder than usual, the UK’s power demand increases as everyone cranks up the heating. As the grid scrambles to ensure there’s enough power online to meet everyone’s needs, the price of power goes up.

- Wind generation is particularly low. Speaks for itself, really. When the wind isn’t blowing, wind generators can’t generate the same amount of (beautifully cheap) power and the grid has to rely on other power sources which can cost a lot more.

Here you can see wind dropping off quite a bit compared to a week ago.

Lots of power stations are offline.

A number of key power stations are offline at the moment – either for scheduled maintenance, or just closed because (confusingly) the price they can get for their energy is currently too low to justify keeping them running.

Calon Energy, a key gas power station, has closed off 2.3GW of gas. Hinkley B and Dungeness, two important nuclear generators, are down a collective 2.2GW for the long term, and another key nuclear site, Heysham 1, has been offline since September. It’s expected to return to service mid-January, but that could be pushed back.

Finally, the Britned interconnector (a massive wire under the sea that runs power from the Netherlands to the UK) had an unplanned shutdown in early December, meaning the maximum capacity of energy that can travel down the wire at one time is 1GW less than usual. This isn’t expected to change until February.

With these sites down, or running with a lower-than-usual energy capacity, the UK’s energy supply is outmatched by demand, which means the grid has to pay an awful lot more to get the energy it needs to power everyone’s homes.

Yesterday, the day-ahead auction hit the highest daily average energy price since September 2016 – £168/MWh. This system ‘tightness’ is expected to last til Friday.

The most important thing to remember: Agile is about changing consumption habits to create long term savings, and crucially, to move the UK towards a wholly new kind of energy system centred on 100% renewable energy.

Pricier days like these are the ‘rough’ that comes with the smooth we saw for months of incredibly cheap pricing throughout Lockdown 1. Over the course of a year, you can still see great savings from Agile as the generally lower prices easily balance out these rare expensive days.

As Agile customer Jeff points out, days like this show Agile working as it should:

Tight margins announced by @ng_eso mean high prices for @octopus_energy agile. Whilst I love low prices, high prices are important as incentives for customers to do the right thing for the electricity system. pic.twitter.com/1UATFgqTX5

— Jeff Hardy (@jjeh102) January 6, 2021

You can make incredible savings with Agile if you move as much consumption as possible to the cheapest times of day, or better yet – make use of energy tech like storage batteries, EVs or solar panels to store cheap power and export it during peak times.

It's with great relief I can announce that I survived and came through the @octopus_energy Agile record pricing week of December 2020 almost unscathed. By dumping into the battery overnight on the cheapest slots (and some into the EV) I averaged 8.4p per unit @energystatsuk 😀 pic.twitter.com/C57Guco1c3

— Mick Wall (@Zarch1972) December 14, 2020

On Agile Outgoing, our smart export tariff, this ‘system tightness’ is majorly working in people’s favour – around 5pm today, anyone on Outgoing who can export power made 90p for every kWh they shared with the grid (for context, the average ‘sell price’ for solar power is between 5 and 6p).

This is where time of use tariffs get really interesting. This evening, customers on Octopus Outgoing are getting paid up to 90p/kWh for power exported to the grid. If my car was V2G enabled I could earn nearly £20! @octopus_energy @ng_eso ⚡️🔋💰💰💰💰 pic.twitter.com/2ytscHQTJM

— John Taylor (@CoppiceJT) January 6, 2021

Thanks to our brilliant Agile customers for being part of this new way of buying power. These days show once again the importance of energy storage and smart energy tech to make the most of green power when it's available, so we can save it to use later (or share it!) when the system is tight. We’re looking forward to the cost of these technologies coming down for all.

As ever, if you decide you’d prefer the security of a fixed rate, just get in touch and we’ll help.

15th September 2020

Low wind, low nuclear and higher demand see wholesale prices increasing a bit, plus, some context on Agile's 'expensive' days...

For the past two days, we’ve seen slightly higher prices on AgileOctopus, sparking a bit of chat between customers.

Low wind generation on the grid, paired with lower than usual levels of nuclear, and higher demand this week as we all try to cool ourselves down through Summer’s final days, have seen wholesale prices going up a little.

The graph below shows the UK's national demand (or DANF – the top black line) compared to renewable generation. You can see wind generation, both on and offshore have dropped far below normal levels.

We wanted to put these “high prices” in context.

The best way to save money on AgileOctopus is to shift your consumption out of expensive peaks.

Today, we saw the 4-7pm peak reach our 35 p/ kWh capped price. That's because demand is really high, renewable generation is super low, and fossil fuels are being burnt to pick up the slack. These deliberate price incentives and deterrents are there to help you change your energy use habits to line up with times when renewable generation is high, and out of times when the grid is strained, and more reliant on dirty fossil fuels.

Agile is designed to encourage you to move you consumption out of the peak to save money, so the best way to make the most out of Agile is by shifting your consumption. Yes, the peak prices on AgileOctopus are high – but prices are well below market rates for the other 18 hours of the day.

The cheapest four hours of tomorrow's pricing sit at 8.3p/ kWh. (That's nearly half what most people pay every day on a standard energy tariff.)

Some of our customers said it best:

I've managed to save anywhere from 6% to 42% in the last 7 days even with these higher prices. As @JibbleBobble says if you are not planning your usage to avoiding the peak then Agile is probably not for you.

— Anthony Breach (@anthonybreach) September 13, 2020

I haven't been great at avoiding peak times recently but even I've been saving by changing appliance times 😊 I enjoy Agile. pic.twitter.com/2Q1E6U6F12

— CountDuckula (@FriedMarsBar) September 13, 2020

Even if you don't shift your usage, Agile is no more expensive than an average tariff – in fact, it's generally still cheaper.

According to AgileOctopus legend Mick www.energy-stats.uk, who uses our open API to publish daily Agile pricing reports, the daily average Agile price for Tuesday 15th September is 15.8p / kWh. Our current standard flexible tariff is going for 14.8p / kWh. So, an AgileOctopus customer’s 'most expensive day' is only a tiny amount more than a regular day on our standard tariff.

It gets better – get a quote for a Big 6 standard variable tariff and you’ll find they’re mostly hovering around the 17p / kWh mark (some a little lower, others even higher). So, again, the rare ‘expensive’ day on Agile is still quite a bit cheaper than any day on a Big 6 standard tariff.

So, to recap – if you use Agile as it was designed, and shift your consumption out of the expensive daily peak, you can save tons of money (and save carbon while you're doing it!)

And, even if you do nothing at all to change your consumption, Agile's most "expensive" day is within a penny of a standard tariff with Octopus (and more than 7% less than the average Big 6 SVT).

Thanks so much to our customers for coming along with us on this crucial experiment for the future of energy, shifting your consumption and changing age-old habits in the fight for the planet. It's amazing to see that so far, this experiment is really working.

Its definitely shifted our usage pattern - I never even knew the dishwasher had a timer till we switched to Agile.

— simon chetwynd (@chetwynd_simon) September 14, 2020

Solar + battery storage means we never draw anything at peak times.

It's obviously disappointing when the price is higher overall but it's what we signed up for, like any variable tariff. We've already adjusted our habits in our house and shift and reduce usage when we can. Information is power and choice is control.

— Mark Ford (@fordsville) September 13, 2020

And if you do find that AgileOctopus doesn't suit your household, we totally understand. We have zero exit fees, so you can switch to another of our tariffs, or to a different supplier, any time.

24th August 2020

Agile prices were bit higher than usual between 4-7pm demand peak due to low wind power generation.

The fairly hefty ‘peak’ price for a few half-hour slots today was down to a few factors.

- As the wind isn’t blowing, we’re low on wind power. The old-fashioned ‘look out the window’ trick proves correct here: wind generation is just pretty low, which means the grid has to rely more on other (pricier, often dirtier) sources of energy.

- Slightly higher wholesale is typical of this time of year. Right about now, generators are often prepping and carrying out maintenance in the run-up to winter which means it’s pretty common to have lower-than-usual availability. When energy is more ‘scarce’ than usual, prices are higher.

19th August 2020

Why were energy prices higher in a heatwave?

During an incredible heatwave, some Agile customers were expecting to see even lower prices than usual – surely when temperatures are up, solar panels are working overtime!? Nope. Wholesale prices were higher than some expected. Why?

- There wasn’t much wind power being generated. In the UK, we have a total wind capacity of over 22GW. On Wednesday, wind output was expected to drop below 3GW, (and down to 1.5GW at peak times) and remain low for the rest of the week.

- The heatwave drove energy demand up, here in the UK and around the world. Hot days always lead to an increased demand for air-con and other emergency cool-down methods. The UK doesn’t have the same air conditioning load as other parts of the world, but what the UK does have will be working overtime to prevent people from melting. The other thing worth noting is that we are connected to Europe via interconnectors. When it's hot in Europe, their demand increases (where air conditioning is far more common) and the prices in that market increases. Traders in the UK will take advantage of the higher prices in Europe and nominate power to be exported further, increasing UK power demand.

- A BONUS ONE: Many people understandably think that hotter days could lead to more solar power. Not so. Solar panels actually lose 10-25% of their efficiency at temperatures above 25 degrees, and are more impacted by factors like cloud cover.

Published on 14th September 2020 by:

Hey I'm Constantine, welcome to Octopus Energy!

×Close window