Energy credit and debit explained

Picture this... it's early October. The last of the summer sun has been and gone. Before wrapping up for a breezy autumnal walk, you log on to your energy account and find that you're £332 in credit. Wow, it's gone up since you last looked. Should you leave it in there? Or request a refund and put it towards something else?

Short on time? Here’s what we'll cover:

- Why you build up credit

- How much credit is too much credit?

- How to get your credit refunded.

- Paying in a different way

- What happens if you're in debit?

Why you build up credit

When it comes to your money, we have two main aims: putting you in control, and keeping you clearly informed so you don’t build up unexpected debt.

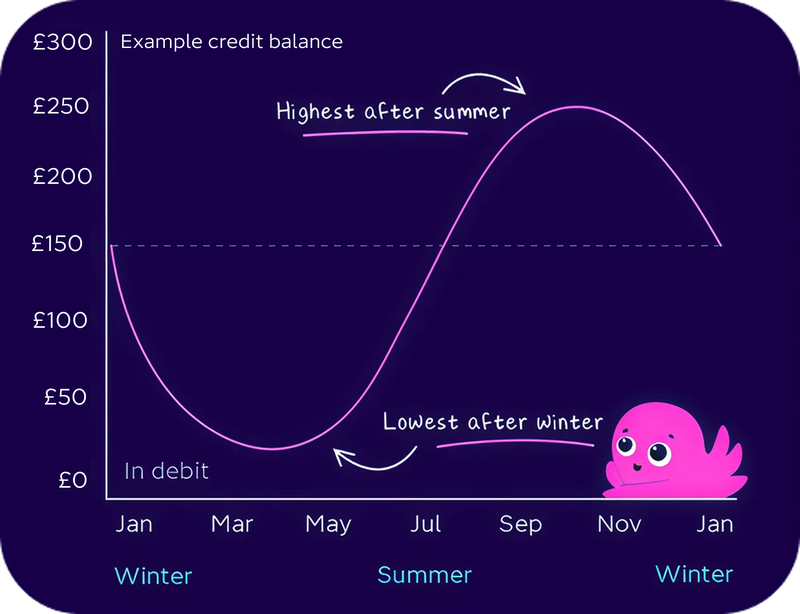

Most customers pay the same amount each month via Direct Debit, but use more energy in winter and less in summer. That means your balance varies throughout the year as you build credit over the summer to offset higher winter bills.

It's a bit like a bear preparing for hibernation. In summer, you build up enough reserves to see you through winter (when you use more heating and payments are higher) so you come out of the frost feeling good (and without more debt than you'd like).

How much credit is too much credit?

A good place to start is looking at how monthly payments vary across the year for direct debit customers.

Your balance will generally be at its lowest around May following higher winter payments. This will even out again when the weather gets warmer and you use less energy.

If you see a substantial amount of credit in your account before the start of summer, you might have more than you need, so it could be worth requesting a refund.

Your balance will usually be at its highest around November. This credit will help to carry you through the winter months when most people use 50% more energy.

On the whole, you should only need up to two and a half months' energy credit in your account. If you have more than that, it might be worth refunding some. Check your balance forecast, or call us if you're unsure.

This a rule of thumb: the reality is more complex. Your balance will depend on the time of year you switched, your consumption, and energy prices.

That's why we created a nifty tool you can use to make sure your account is on track.

Balance Forecast shows how your balance will fluctuate over the year if your monthly payments change, helping you make a more informed decision about your credit.

This is your money. So you can request a refund, online or through your app.

All we need are meter readings so we can get your account charges up to date first.

Occasionally there might be a step you need to take first (like submitting a new meter reading) or you might need to talk to us so we can fix something on your account first to get it updated.

Whatever happens, you're in control.

How to refund credit

If you've built up more credit than you need and you want to refund some or all of it, it's super easy to do on your online dashboard or app. Here's how:

- Firstly, make sure you've sent us a meter reading in the last 14 days. Your account needs to be up-to-date first.

- Log on to your account as usual.

- In the payments section, click 'Refund some credit'.

- Let us know how much you'd like to refund.

- All being well, you should receive your money within 7 days, but it can take up to 2 weeks if there are delays in bank processing.

Can I pay in a different way?

Yes. We know some prefer to pay for their full energy bill each month and that’s absolutely fine. Just contact us and say you’d prefer to pay by a variable Direct Debit.

With a variable Direct Debit you don't pay a set amount each month. Instead, we'll take a payment for your full bill shortly after issuing each energy statement.

Bear in mind: you'll likely pay more over the winter months when the heating goes on and the days are shorter. These larger payments can come as a surprise after a year of paying less, and might feel unmanageable for some.

What happens if I’m in debit?

If you pay by a monthly fixed Direct Debit, it’s fairly normal to dip into debit over the cooler months when you’re more reliant on heating. This tends to even out again over summer, when you’d sooner take a cold shower than crank up the radiators. However, if you're struggling to stay on track or keep up with your payments, we’re always here for you. These are some things we can do to help.

Published on 19th September 2024 by:

Hey I'm Constantine, welcome to Octopus Energy!

×Close window